section 127 income tax

The chapter discusses rules and criteria as they apply to corporations and functional tax reporters. Payments made to a non-resident contractor.

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

114113 to which such amendment relates see section 101s of Pub.

. And 4 meet the requirements of a charitable organization provided by Sections 1118e and f for which purpose the functions for which the association is organized are considered to be charitable functions. A taxpayers identity the nature source or amount of his income payments receipts deductions exemptions credits assets liabilities net worth tax liability tax withheld deficiencies overassessments or tax payments whether the taxpayers return was is being or will be examined or subject to other investigation or processing or any other data received by. This publication supplements Pub.

9734 substituted section 127 or 129 for section 127. Use Form 1099-NEC to report nonemployee compensation paid in 2021. Income Tax Paid by Investors other than Promoters Remission Order.

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition assessment and collection of the federal income tax violates the United States ConstitutionThese kinds of arguments though related to are distinguished from statutory and administrative arguments which presuppose the constitutionality of the income tax as well as. 1984 with respect to obligations issued after such date in taxable years ending after such date see section 127g1 of Pub. Relief where UK income tax borne by foreign estate.

Tiny Hearts of Maldives. 2 federal income tax based on the tax rate for a single person claiming one personal exemption and the standard deduction. 22 Filing requirements for earning an investment tax credit on an SRED expenditure.

Persons other than individuals and banks. No penalty or interest shall be imposed on any failure to withhold under subtitle C of the Internal Revenue Code of 1986 formerly IRC. Compensation excluded for federal income tax purposes.

The Scout Association of Maldives. Which related to service performed in any calendar quarter in the employ of any organization exempt from income tax under section 501a other than an organization described in section 401a. 1396b From the sums appropriated therefor the Secretary except as otherwise provided in this section shall pay to each State which has a plan approved under this title for each quarter beginning with the quarter commencing January 1 1966an amount equal to the Federal.

98369 set out as a note under section 871 of this title. Relief where foreign estates have borne UK income tax. Net income from solar panels included in Class 432.

97248 set out as a note under section 1395x of Title 42 The Public Health and. A revised deduction worksheet is included at the end of this bulletin as an appendix. 51 Agricultural Employers Tax Guide.

Deduction of limited CCA because of the application of the specified energy property rules 30 30. 15 Employers Tax Guide and Pub. We would like to show you a description here but the site wont allow us.

115141 effective as if included in the provision of the Protecting Americans from Tax Hikes Act of 2015 div. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children. Compilation of Social Security Laws 1903.

Canada Communication Group Divestiture Regulations SOR97-127. A foreign tax credit FTC is generally offered by income tax systems that tax residents on worldwide income to mitigate the potential for double taxationThe credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction. Limited and discretionary interests.

This chapter discusses Section 261 of the Income Tax Act which contains the general rule that amounts determined for the purposes of the Act are to be determined in Canadian currency. 9735 see section 128e2 of Pub. 5 expenses for the cost of health insurance dental insurance or cash medical support for the obligors child ordered by the court under Sections 154182 and 1541825.

Income treated as bearing income tax. 30 Jun 22 128. 3 qualify for an exemption from the franchise tax under Section 171060.

3 Sections 116 and 118 do not apply with respect to increases in rent for a rental unit due to increases in the tenants income if the rental unit is as described in paragraph 1 2 3 or 4 of subsection 1 and the tenant pays rent in an amount geared-to-income due to public funding. 1 2021 and Dec. 31 2024 inclusive are excluded from federal gross income.

1954 relating to employment taxes with respect to amounts excluded from gross income under section 127 of such Code as amended by this section and determined without regard to subsection a2 thereof. 1275 investment tax credits 1291 dividend refunds. Taxpayers income from all sources for the tax year.

For a person or couple to claim one or. 31 Aug 21. 3 state income tax.

Relief where UK income tax borne by foreign estate. Order Declaring that all Provisions of Part X of the Financial Administration Act Other Than Section 90 Apply to PPP Canada Inc. It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

Amendment by section 128b of Pub. CBDT notifies Scrutiny criteriaGuideline for following parameters for compulsory selection of returns for. 97248 effective as if such amendment had been originally included as part of this section as this section was amended by the Omnibus Budget Reconciliation Act of 1981 Pub.

Under Section 9675 of the American Rescue Plan Act of 2021 student loans discharged between Jan. I Community Service Clubs. Student Loan Debt Discharge.

Low income adults with no children are eligible. 115-97 lowered the federal income tax withholding rates on supplemental wages for tax years beginning after 2017 and before 2026. Amendment by section 101b of Pub.

The credit generally applies only to taxes of a nature similar to the tax being reduced by the credit. The amount of EITC benefit depends on a recipients income and number of children. In order to earn an ITC a claimant must file a prescribed form see section 32 containing prescribed information see sections 42 to 43 in respect of an ITC amount earned on an outlay expense or expenditure for SRED on or before the day that is 12 months after the.

Taxpayers income for the tax year excluding the income from the solar panels included in Class 432 na. See Withholding and depositing taxes in section 4 for the withholding rates. Income from which basic amounts are treated as paid.

Income specified in the section 55a of the Income Tax Act. The 2021 Form 1099-NEC is due January 31 2022. For disallowance of deduction for interest relating to tax-exempt income see section 265a2.

CBDT Issues Guidelines for compulsory selection of Income Tax returns for Complete Scrutiny during the Financial Year 2022-23 and procedure for compulsory selection in such cases vide Instruction No.

Incometaxfile Twitter Search Twitter

Study Mississippi Tax Laws Place Higher Burden On People Of Color Sct Online

Starbucks College Achievement Plan Program Document Pdf Free Download

Federal Tax Benefits For Higher Education

Collapsible Corporations In A Nutshell

040825 Aicpa Educati The Gateway To The Us Labor Market

Income Tax Ordinance 2001 Change Made To Section 127 1 Discriminatory Sc Business Recorder

Solved Jack S Mba Tuition Books And Fees For 2021 Were Chegg Com

Free Oregon Durable Financial Power Of Attorney Form Pdf Word Eforms

Certain Trusts May Help Lift The Weight Of A State Tax Burden Putnam Investments

A Deep Dive Into Student Loan Repayment Assistance

Rethinking Benefits In The Pandemic Era Plansponsor

Fringe Benefits Presented By Michael O Neill Manager Payroll And Tax Services University Of California Office Of The President And Dominic L Daher Ppt Download

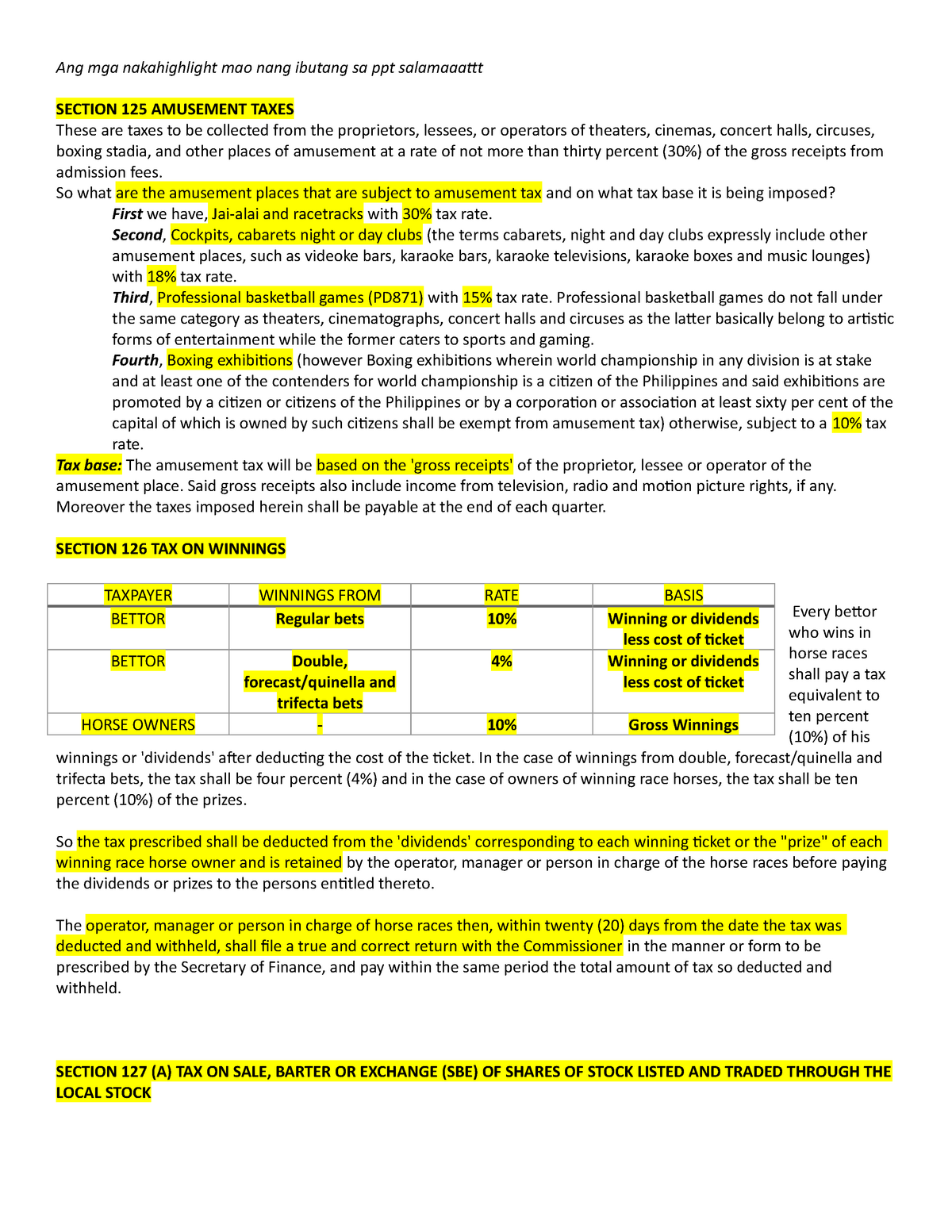

Chapter 5 Section 127 Pdf Stocks Initial Public Offering

Section 127 Of Income Tax Act Archives Scc Blog

5 Advantages Of An Employer Tuition Reimbursement Program

Appeals Under The Income Tax Ordinance January 2016 By Syed Hassaan Naeem Ppt Download

Cares Act Allows Some Tax Free Employer Student Loan Payments Coronavirus Covid 19 Guidance For Businesses

Comments

Post a Comment